Martin Lewis says get handed £1,700 free cash with one bank account | Personal Finance | Finance

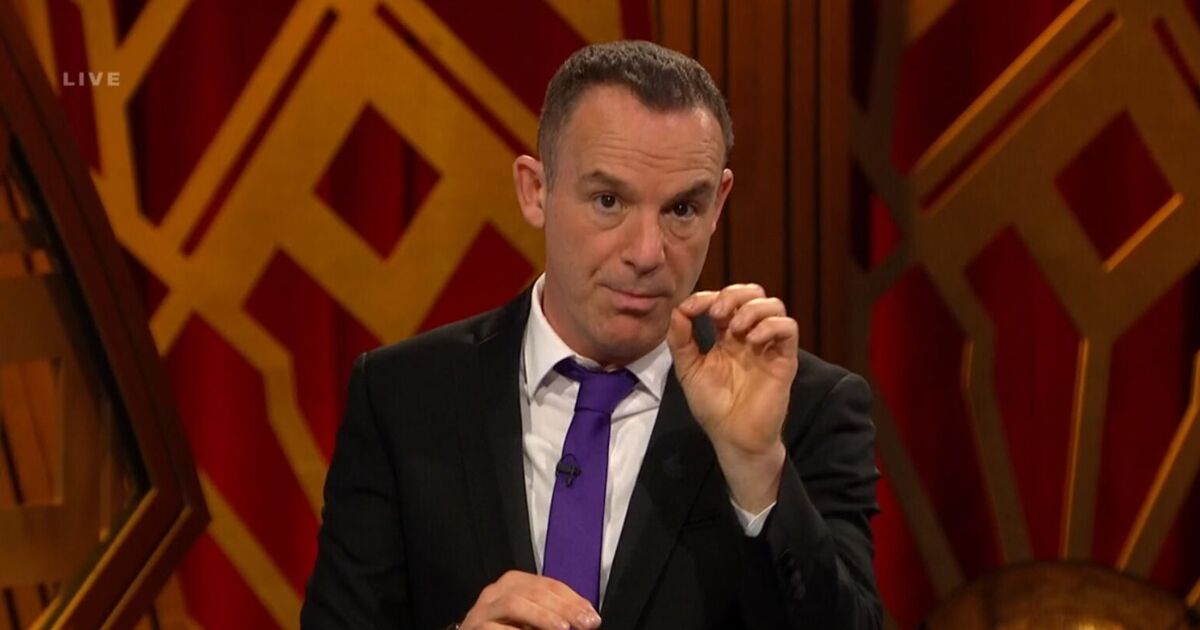

Money Saving Expert Martin Lewis has outlined to people how they can get as much as £1,700 with one single bank account dedicated just to earning money from bank switching bonuses.

Returning on his trademark show, The Martin Lewis Money Show Live on ITV1 and ITVX, Martin told his avid viewership of a fully legal way to earn cash from banks with a dedicated account just for switching for free handouts.

Martin was asked on his show whether switching banks ‘quite a bit’ was bad for your credit score, but he explained how a credit score isn’t actually useful if you don’t need to apply for credit.

Martin’s audience member asked: “I’ve switched my current account quite a bit. Will that affect my credit score in the long term?”

Martin asked him how much he was paid for switching accounts, to which the man replied “almost £1,000.”

The expert responded: “Almost a thousand? There are a lot of people out there who switch bank accounts all the time. If you were to do one switch, this is for everybody, if you do one switch, well it’s an application on your credit file which has a very minor short term negative effect.

“Lots of those in a short space of time can be an impact, and banks also like to see evidence of longevity, so that’s also slightly negative, so I wouldn’t switch my bank account if I had a mortgage application due in the next two months.

“Longer than that, I wouldn’t care. It’s only very minor and it doesn’t really have a hit.

“Switching very regularly can have a bigger impact. Do you have a use for your credit worthiness?

“[No?] If not it will have an effect but why should you care?

“People always think ‘oh it will hurt my credit score’, your credit score is the thing to use, if you’re not going to use it do what’s best for you to make money.”

Martin then asked his audience who else has used bank switching to make money multiple times, and heard from one man in the studio who had earned £1,700 from bank switches.

He then explained how the ‘mule’ account works: “So. Lots of people are doing it, you have to be careful, you have to do it right, but yeah it’s worth doing.

“If you are going to do it, one of the ways they do it is they have a ‘mule’ account. Which is where they set up a separate account just for switching bank accounts, make sure you have a couple of direct debits going to it, make sure you’ve got some money going into it, and then you use that, and you keep your normal account and you have a mule account for switching.”