Martin Lewis announces huge Carer’s Allowance victory with threshold set to change | Personal Finance | Finance

The Carer’s Allowance earnings threshold is set to increase by around £30 a week from April 2025.

Chancellor Rachel Reeves is expected to announce the change in tomorrow’s Autumn Budget.

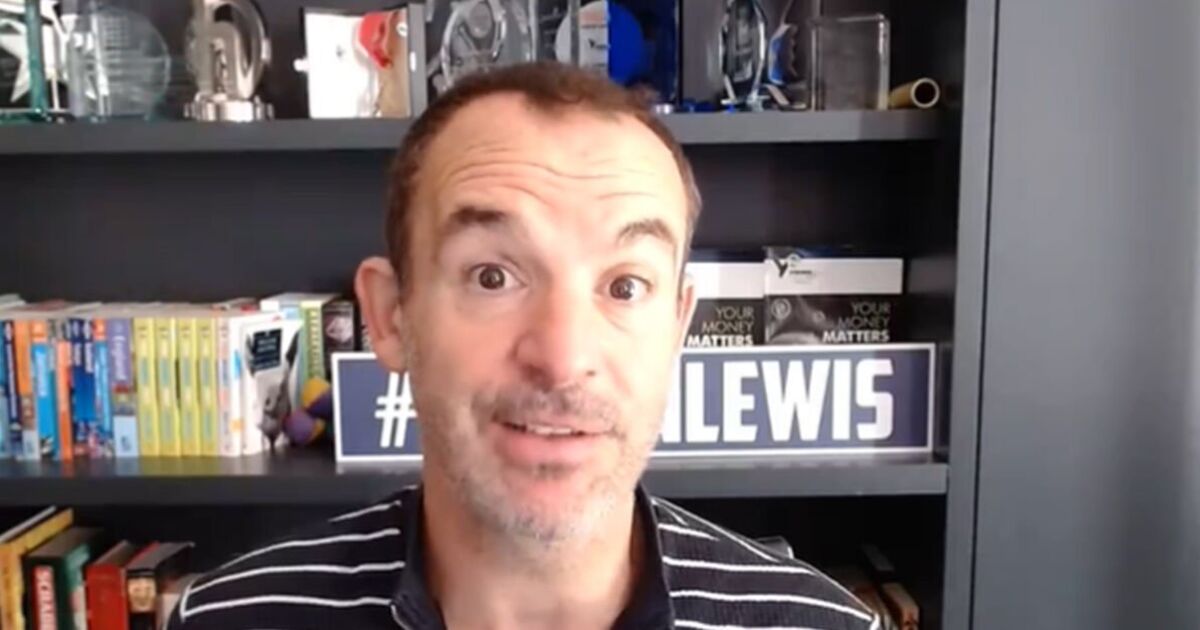

Money Saving Expert founder Martin Lewis confirmed the change on social media platform X, stating: “CONFIRMED: Good news. The Carers Allowance earnings threshold will be increased from £151 to at least £183 in the #Budget tomorrow, starting April 2025. So carers can earn more and still receive the allowance.” (sic)

However, he noted that some questions about the Department for Work and Pensions (DWP) benefit remain unanswered. For instance, will the allowance itself increase, and “crucially,” will the “cliff-edge” be replaced with a taper so that recipients don’t lose all their benefits for earning just 1p over the limit?

Mr Lewis added: “PS I’ve written at least £181 as it’s currently £151 and the confirmation is it’ll rise ‘over £30 extra a week’. We think as it’s based on minimum wage hours it’ll be £183, but that isn’t confirmed.”

Carer’s Allowance is a benefit distributed by the DWP and is worth up to £81.90 a week for those who spend at least 35 hours a week caring for someone who receives a certain disability benefit.

To qualify, claimants must earn £151 or less a week after tax, National Insurance, and expenses.

The low threshold has faced growing criticism, as those who earn just a penny more lose their benefits, forfeiting essential financial support.

We’ll be bringing you the very latest updates, pictures and video on this breaking news story.

For the latest news and breaking news visit:** **/finance

Stay up to date with all the big headlines, pictures, analysis, opinion and video on the stories that matter to you.

Follow our social media accounts here onhttp://facebook.com/DailyExpress and @daily_express